ONLINE SEMINARS

Estate Planning in Plain English

Saturday, March 15, 2025 • 10:00am - 11:30am

This easy to understand 90 minute seminar will help you learn how to protect your family and wealth.

IN-PERSON SEMINARS

Estate Planning for Your Second Half of Life

Thursday, March 27, 2025 • 2:00pm - 3:00pm

Should you have difficulty registering, please contact us at

(703) 448-6121 or olivia@miorinilaw.com.

|

Is Long-Term Care Insurance Right for You?

|

As we age, the possibility of needing assistance with daily activities becomes a reality for many. Long-term care insurance (LTCI) is one way to prepare for such needs, providing financial support for services like home care, assisted living, or nursing home care. Let’s explore what LTCI is, its pros and cons, tips for selecting the right policy, and when and where to get it.

Long-term care insurance is a policy designed to cover costs associated with extended care services not covered by health insurance, Medicare, or Medicaid. These services might include assistance with activities of daily living such as bathing, dressing, and eating, or specialized care for conditions like dementia, Alzheimer’s or Parkinson’s disease.

LTCI is a good idea for many reasons, although it may not be the right fit for everyone.

|

LTCI can help protect your savings and assets from being depleted by long-term care costs, which can quickly add up. Policies often allow you to choose between receiving care at home, in an assisted living facility, or a nursing home which provides flexibility. LTCI means you have coverage and your loved ones won’t need to shoulder the financial or caregiving responsibilities alone, relieving the family burden. It can also provide benefits before Medicaid eligibility kicks in, offering higher quality care options.

On the other hand, LTCI premiums can be expensive, and they’re not guaranteed to stay the same over time. Further, if you never need long-term care, the money paid into the policy doesn’t get paid back to you or loved ones. Some policies also require a health screening, and pre-existing conditions may lead to denial or higher premiums. LTCI policies are often complex, and understanding the terms, conditions and exclusions can be challenging and require careful attention.

If you’re considering getting LTCI, the best time to buy is in your mid-50s to early 60s. This typically involves lower premiums and higher likelihood to qualify based on health. Waiting until you’re older, or your health declines can result in significantly higher costs, or even denial of coverage altogether.

If you are interested in LTCI be sure to consult with your estate planning attorney and your financial advisor. Your estate planning attorney can review your life circumstances and perhaps offer alternatives such as early trust planning or other strategies.

If LTCI is the right choice for you, you may work with a major insurance company or a trusted financial advisor to help find the best policy to fit your needs. If you’re still employed, some employers offer LTCI as part of their benefits package, often at discounted rates. There are even online platforms that allow you to compare policies and premiums to select the right policy.

|

By understanding the ins and outs of long-term care insurance, you can make informed decisions that align with your financial and personal needs. Start exploring options early to secure the most favorable terms and ensure you’re prepared for whatever the future holds.

|

Beneficiary Designations: Why Keeping Them Updated Matters

|

When it comes to estate planning, beneficiary designations are a critical yet often overlooked detail. These designations determine who will receive your assets, such as retirement accounts, life insurance policies, and bank accounts, upon your death. Keeping them current is vital to ensuring your wishes are honored and your estate plan functions smoothly.

|

Many people don’t realize that beneficiary designations take precedence over other estate planning documents, such as wills or trusts, when it comes to distributing certain assets. For instance, even if your will states that your assets should go to your children, if your life insurance policy lists an ex-spouse as the beneficiary, the ex-spouse will receive the payout. This highlights why keeping beneficiary information up-to-date is crucial.

So what happens if beneficiary designations are outdated or incorrect?

- Unintended Recipients: Failing to update your beneficiaries after major life events—such as a marriage, divorce, or the birth of a child—can lead to assets going to someone you no longer intend to benefit, or going to beneficiaries unevenly.

- Legal Complications: If no beneficiary is listed or the named beneficiary has predeceased you, the asset may go through probate, delaying the distribution and potentially incurring additional costs.

- Family Disputes: Conflicts can arise among family members if the beneficiary designations don’t align with your current wishes or other aspects of your estate plan.

It is important to regularly review your beneficiary designations to reflect life changes. Life is dynamic and your estate plan should be, too. Properly updated beneficiary designations allow assets to pass directly to intended recipients, avoiding the time-consuming and costly probate process. Furthermore, beneficiary designations that don’t align with your will, trust or other estate planning documents may cause discrepancies and issues both legally and within your family. Worse, it could affect tax liabilities for your estate or your beneficiaries.

No matter whether you are beneficiary designating all of your assets, or have an estate plan in place with a will or trust, it is important to consult with an estate planning attorney prior to making these decisions. Many factors come into play, and an estate plan may not work correctly with inaccurate beneficiary designations in place.

|

Beneficiary designations are more than a simple form; they’re a powerful tool that directly impacts your estate plan. By keeping them updated and aligned with your overall strategy, you can ensure your assets are distributed according to your wishes while minimizing potential legal complications and family disputes. Regular reviews and professional guidance are key to making the most of this essential component of your estate plan.

|

|

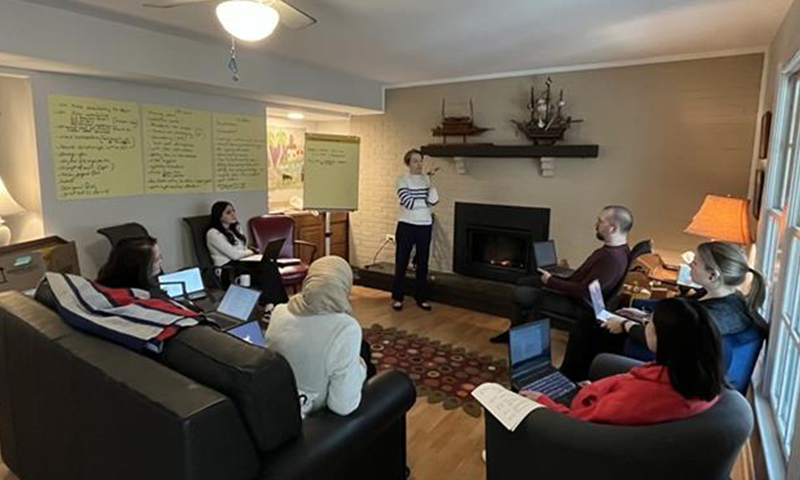

At the end of January, the team spent two days together planning for the year on how to better serve their clients in 2025. During the retreat, the team bonded by taking a painting class from Davi D’Agostino and learning how to make a traditional Afghan dish from Rukhsar and Parina!

Helena joined Miorini Law as an executive assistant to Yahne Miorini in February of 2025. She holds dual bachelor's degrees from Sciences Po Paris and Columbia University, where she studied Anthropology. She also holds a master’s degree in human rights and humanitarian action from Sciences Po Paris. She speaks French and English.

|

|

|